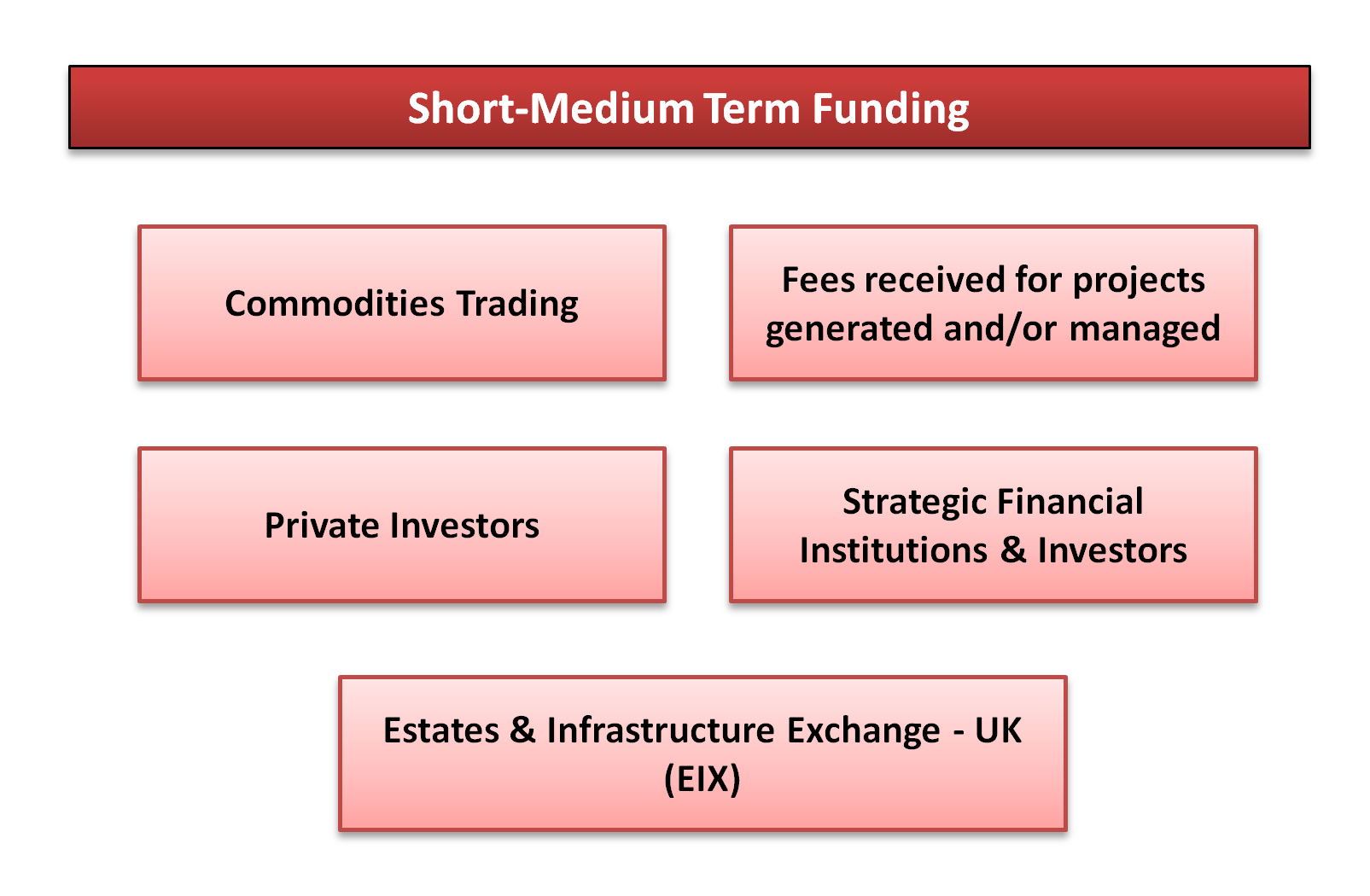

Medium Term Funding

Estates & Infrastructure Exchange (EIX)

GSEG has a strategic partnership with London based Estates and Infrastructure Exchange (EIX) as a platform to raise independent project finance. EIX, who are Authorised and Regulated by the UK Financial Conduct Authority, is the first exchange to focus exclusively on estates and infrastructure as an asset class. The main instruments financed and traded are Project Bonds for worldwide infrastructure and development projects.

EIX was established to help bridge the USD15 trillion infrastructure investment funding gap by 2040 with the trillions of dollars of private capital, both foreign and domestic, searching for a home. Through two models, EIX will transform an illiquid asset class into a liquid one and can enable reduced regulatory capital requirements under Solvency II.